August 2019 Real World Travel, Budget, Deal, and Life Hacking

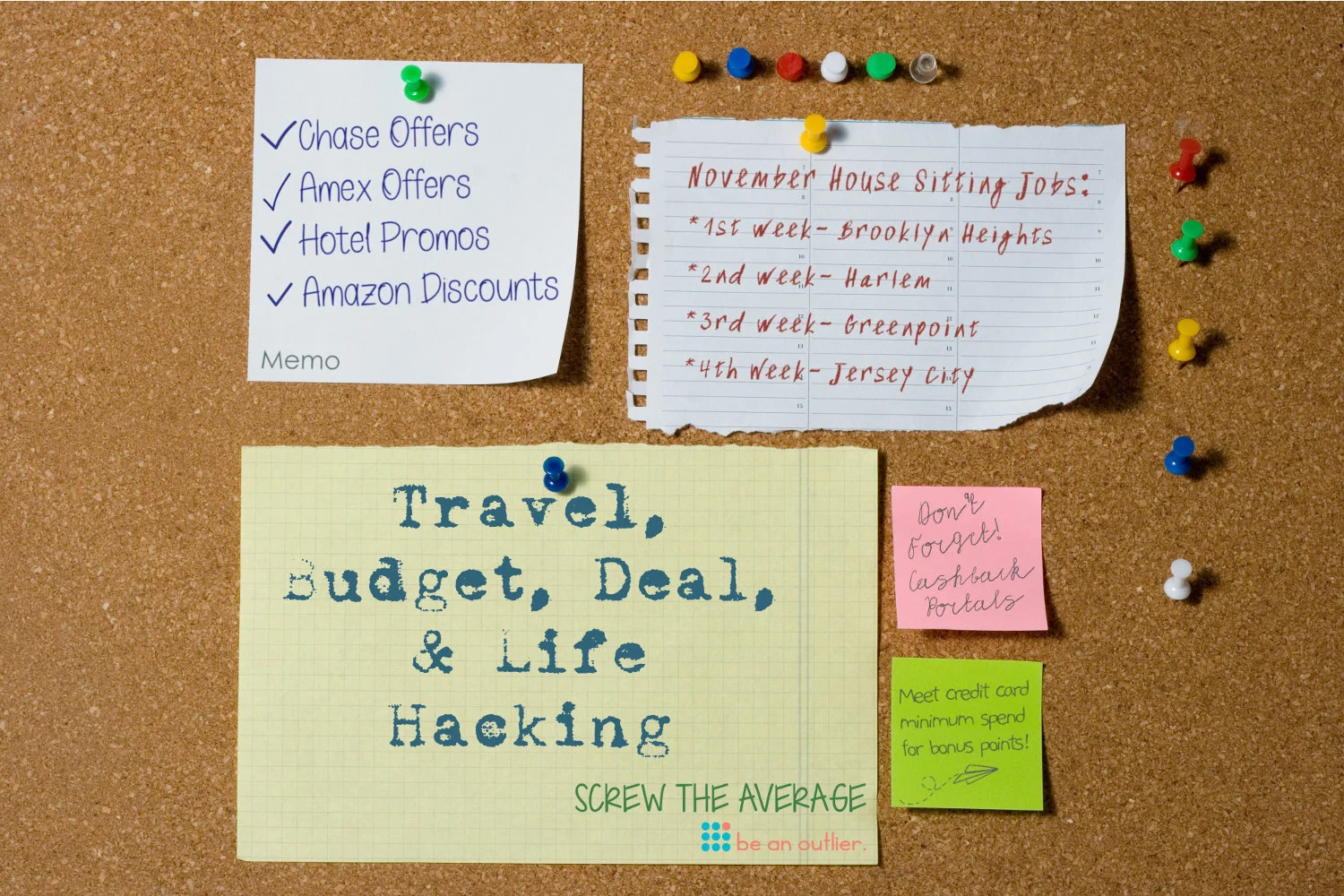

One of the ways we’re able to keep a trim budget is by taking advantage of great deals. So when it comes to travel, budget, deal, and life hacking, we try to be on top of it! Read on to see the gift card deals, reward points and miles, and more that we scored this month.

This is a recurring series where we talk about our travel, budget, deal, and life hacking for the month. We share with you in hopes that you’ll find a few takeaways to implement yourself.

Disclosure: We may receive a commission for links on our blog. You don’t have to use our links, but we’re very appreciative when you do. Thanks again for your support, we hope you find our posts and information helpful! Learn more.

As a digital nomad couple pursuing financial independence, retire early (FI/RE) we’re often asked how we keep our budget and expenses so low.

Being minimalists and frugal helps, but there’s a bit more to it than that. We’re able to get exponential savings and benefits with travel hacking, stacking deals and offers, house sitting, strategically using miles and points, and being flexible enough to take advantage of opportunities as they come up!

Quick Links

If you’re wondering how to travel internationally, or simply vacation nearby and not spend a fortune on airfare or hotels, then we’d like to welcome you to the world of ‘travel hacking’. See what credit cards we carry, and how we take full advantage of the points and miles we’ve earned.

Amazon and American Express Rewards - Airbnb Gift Card

Last month we took advantage of a deal with Amazon and American Express Rewards and saved 20% on Starbucks and Netflix gift cards.

This month the deal we got was even sweeter. By purchasing a $60 Airbnb gift card on Amazon and using at least one American Express Rewards point, we saved 50%!

“We saved 50% on a $60 Airbnb gift card, for a total of $30 in savings!”

Tip: Gift cards are a great way to take advantage of deals like these, especially when there’s nothing in particular you need to purchase. To make the most of your money, consider purchasing gift cards on services you already use or stores you regularly shop at. Otherwise, they make great gifts!

Don’t miss our Ultimate Gear and Packing Lists! Whether you’re traveling long-term or going on a short vacation, we'll show you how to travel with a single carry-on. We share our packing lists (his and hers!), packing tips, and our favorite gear. Plus, we discuss what we don’t carry and why!

Be sure to use the best credit card you have for the specific category you’re spending in (travel, restaurant, office supplies, etc.) to maximize savings/points further.

In the case of Lyft, credit card transactions code as ‘travel’ so you’ll want you be sure and use the best card (highest multiplier) in that category. Cards like the Chase Sapphire Reserve (3x on travel), Wells Fargo Propel (3x on travel), Citi Premier (3x on travel), etc.

The exception to using the card with the best travel multiplier is when you’re trying to hit a minimum spend to get a bonus on a specific credit card.

Price shop all ride sharing services: Uber, Lyft, Juno, etc. Also, you can use the Bellhop app to compare services.

Review ride sharing reward programs to find the program that best suits your riding habits.

If possible, avoid surge pricing. Prices increase in situations where demand is especially high for rides, like rush hour or when it’s raining.

When using a ride sharing service that offers reward points or miles on other reward programs, be sure to connect the appropriate accounts. For example, Hilton, JetBlue, and Delta accounts should be connected to your Lyft account.

Lyft - Business Rewards

For every five Lyft business rides completed (at a minimum of $10.00) a $5.00 ride credit is added to your personal account.

Shannon rides frequently with Lyft for work so she accumulates more $5.00 personal Lyft ride credits than we can use. The only downside to this reward perk is that you can’t combine credits on a ride. Meaning, only one $5.00 personal Lyft ride credit can be used per ride. Sadly, $5.00 doesn’t get us very far in NYC!

“We saved $35.00 with ride credits on Lyft this month!”

Lyft - Hilton Honors Reward Points

Every dollar you spend on Lyft rides (economy, luxury, and extra seats) earn three Hilton Honors points! If you’re taking advantage of Shared Lyft rides then you’ll be earning two points per dollar spent.

We earned 551 Hilton Honors points thanks to Lyft business rides this month.

“Per our own valuation of $0.006 cents per point, we earned $3.31 in Hilton Honors points!”

Lyft - JetBlue Award Miles

For every Lyft ride you take to or from an airport you’ll earn 30 JetBlue points!

This month we earned a total of 90 JetBlue points by using Lyft to go to and from the airport for business!

“Per our own valuation of $0.015 a mile, we earned $1.35 in JetBlue miles!”

Note: Unfortunately, Lyft and JetBlue announced their partnership ended on September 9, 2019. So, we hope you took advantage of this opportunity while you could!

Lyft - Delta SkyMiles

Link your Delta SkyMiles account to Lyft and get one mile for every dollar spent on Lyft rides. Plus, get two miles for every airport ride!

This month we earned a total of 297 Delta SkyMiles by using Lyft to get around town and go to and from the airport for business!

“Per our own valuation of $0.02 a mile, we earned $5.94 in Delta SkyMiles!”

World Elite MasterCard Credit Cards

World Elite credit card holders receive a $10 credit after taking five Lyft rides in a calendar month. The credit is automatically applied to your next ride and is capped at one per month.

We just received a World Elite MasterCard but have yet to use it with Lyft. We’re excited to do so and will hopefully report savings next month!

Our tool box is full of resources! From travel hacking to house sitting, digital nomad jobs to privacy and security, financially independent retire early (FI/RE) to entertainment, plus travel hacking (credit cards, miles, points, and rewards), and much much more…

Minimum Spend Met on IHG Rewards Club Premier Credit Card

This month we were approved for the IHG Rewards Club Premier credit card. The signup bonus and card features for the first year are pretty darn impressive.

IGH Rewards Club Premier Credit Card Benefits

Earn 125,000 points if you spend $3,000 in the first three months.

Earn a total of 40 points per dollar on IHG hotel stays with 25 points per dollar for using the card and 15 points per dollar as an IHG Rewards Club member. After the first year, this decreases to a total of 25 points per dollar on IHG hotels stays (15 for the card and 10 for being an IHG Rewards member).

4 points per dollar on all other purchases. After the first year this changes to 3 points per dollar on gas, grocery store, and restaurant purchases, and 1 point on everything else.

We unfortunately found this improved offer after the fact and were denied the extra $50 offer by Chase. But please take advantage of it if you can!

The card has an $89 annual fee, but the benefits in our opinion are well worth it for the first year. We’re even considering continuing to hold this card so that we can take advantage of the annual free reward night and the point multiplier when paying for IHG stays.

Meeting the Minimum Spend: Paying Taxes

To meet the $3,000 minimum spend on the card and earn the 125,000 IHG Rewards Points, we put some travel spend on the credit card, as well as paid some of our self employed state taxes. This incurred a $24 fee for paying with a credit card, but the value of the points well out weigh the fee!

“We spent $24 in credit card fees to partially meet the minimum spend. We haven’t received our bonus points yet! ”

Miles Earned with Flights: Delta

This month we also earned miles the old fashioned way, by flying with Delta.

Shannon flew only once this month for work and earned 1,005 Delta SkyMiles.

“Per our own valuation of $0.02 a mile we earned $20.10 in Delta SkyMiles!”

Marriott Platinum Elite Status, Hotel Stays, and Credit Card Spend

Earn Marriott’s Platinum Elite status by staying 50+ nights (including award nights) within a calendar year.

This month we took advantage of the following Marriott Platinum Elite benefits:

Enhanced internet access

50% bonus on earned points

4 pm late checkout

Room upgrades

Free breakfast

Club lounge access

August was a slower travel month for us, but we still earned a few Marriott Bonvoy points. With our 50% point bonus, quarterly promotions, and points earned by paying for stays with our Marriott Bonvoy credit card, we earned 2,258 Marriott Bonvoy points this month.

“Per our own valuation of $0.01 cents a point, we earned $22.58 in Marriott Bonvoy points!”

Tip: Make the most of your Marriott stays by paying with you Marriott Bonvoy credit card. You’ll get an additional 6x multiplier on points earned and end up scoring big!

Marriott Free Night Award Redemption

There are many reasons we hold the Marriott Bonvoy credit card, one of which is the annual Free Night Award. Each year Marriott gives us a certificate for a free night at any of its properties (categories 1-5).

This year we took full advantage of our Free Night Award certificate and reserved a room at the Residence Inn New York Manhattan/Times Square for Shannon’s birthday.

The Residence Inn New York Manhattan/Times Square is a category five Marriott property (which has since been upgraded to a category six) and has the distinction of being the tallest hotel in North America. We were given a room with a view of Times Square on the 64th floor (out of 65!). The cash rate for this room was $350.

“We paid only the taxes of $5.50, saving $344.50! ”

Tip: The Marriott Free Night Award only covers the cost of the room. In other words, taxes and resort fees aren’t included and must be paid out of pocket. Make the most of your free night by finding a hotel that doesn’t charge a resort/destination/urban fee.

London, San Francisco, Paris, New York City, Athens and more?! Trusted Housesitters has allowed us to travel the world on a budget, but more importantly given us an opportunity to make new friends and have cute and cuddly companions along the way. Sign up and start your next great adventure!

Hilton Diamond Status, Hotel Stays, and Credit Card Spend

Earn Hilton’s Diamond Elite status by staying 60+ nights (including redemption nights) within a calendar year.

This month we took advantage of the following Hilton Diamond Elite benefits:

Premium WiFi

100% bonus on earned points

Executive lounge access

No resort fees on reward stays

Room upgrades

Free breakfast

2nd guest stays free

Late checkout

With our 100% Diamond Elite point bonus, quarterly promotions, and additional points earned by paying for stays and everyday spend with our Hilton Surpass credit card, we earned 25,183 Hilton Honors points this month.

“Per our own valuation of $0.006 cents a point, we earned $151.10 in Hilton Honors points!”

Tip: Make the most of your Hilton stays by paying with you Hilton Surpass credit card. You’ll get an additional multiplier on points earned and end up scoring big!

Hilton Reward Points for Listening to a Five Minute Pitch

This month we called Hilton customer service to make a change to a reservation and were offered an opportunity to make 500 Hilton Reward Points. We simply had to listen to a five minute pitch on a vacation package.

It truly did take only five minutes, we declined the vacation package, and within a few minutes had an additional 500 Hilton Reward Points in our account!

“Per our own valuation of $0.006 cents a point, we earned $3.00 in Hilton Honors points!”

Three dollars for five minutes of our time works out to $36.00 an hour. Not bad!

House Sitting - No Rent or Mortgage

In November of 2016 we completed our first house sitting job. We loved it so much that we continued traveling (out of one 36-litter backpack each) and house sitting around Europe for the next year. In that first year, we completed 18 house sitting jobs!

After a year in Europe (3 continents, 26 countries, and 60 cities) we came back to North America and chose to keep house sitting full time.

Now, nearly three years after our first house sitting job we’re nearing our 50th house sit! As we’re currently house sitting primarily in New York City, we’re saving a considerable amount of money by not paying rent, a mortgage, or daily hotel/Airbnb costs.

“We spent $216.79 in rent, mortgage, Airbnb, and hotel costs!”

Here’s a break down of where we stayed and how much we saved by house sitting in August:

Tip: House sitting isn’t just a ‘free place to stay’. We consider house sitting a job because it takes work. See if house sitting is right for you!

Final Thoughts

Compared to July, August was a slow travel month. But we made up for the slow month of travel hacking by taking advantage of a few great deals!

We’re excited to see what September brings…